1 - How much do you need to save for a secure retirement?

Determining how much to save for retirement should be a simple exercise. In this article we'll breakdown the process into simple, easy to follow steps. Along the way, if you need assistance our advisory team is available at Advisory Support

Step 1 - Determine how much income you need at retirement

- 70% of your current gross income. The rule-of-thumb is that you will need at least 70% of your current income during retirement. We refer to this as your "target retirement benefit".

- Calculation:

- Box 5 of your W-2 multiplied by 0.70 = target annual retirement benefit

Example: $40,000 gross compensation in Box 5 of your W-2 x 0.70 = $28,000 target retirement benefit

- Box 5 of your W-2 multiplied by 0.70 = target annual retirement benefit

- Calculation:

- Estimate social security benefits. If you work to your Normal Retirement Age (defined by the Social Security Administration and based on your date of birth), social security is expected to repalce a portion of your current income. However, the more you make before retirement the less you can expect in social security benefits.

- Example: Annual Pre-retirement income of $40,000 | social security replaces approximately 51.4%

Example: Annual Pre-retirement income of $80,000 | social security replaces approximately 41.7% - Benefit calculation. Using the Social Security Administration's calculator (in today's dollars), estimate your monthly social security benefit.

- Expected annual social security benefit. Multiply your estimated social security benefit by 12 to arrive at your expected annual social security benefit.

Example: $1,707 monthly benefit x 12 = $20,484 (estimated annaul social security benefit)

- Expected annual social security benefit. Multiply your estimated social security benefit by 12 to arrive at your expected annual social security benefit.

- Example: Annual Pre-retirement income of $40,000 | social security replaces approximately 51.4%

- Annual income needed from personal investments/savings. The difference between your "target retirement benefit" and social security benefits is the amount that you will need to pull from savings or other investments (i.e., retirement accounts) during retirement. Since this is the gap between your target retirement benefit and social security benefits, we refer to this as the "gap funding" which will come from your personal savings or investments, etc.

- Example: $28,000 target retirement benefit - $20,484 social security benefits = $7,516 gap funding; annual income from personal savings or investments

Step 2 - Calculate how much you need to have accumulated when you retire.

- Lump sum at retirement calculation:

- Gap funding from #3 above multipled by the number of years in retirement. It's reasonable to assume 30 years during retirement.

- Example: $7,516 gap funding x 30 years = $225,480 the amount you need to have accumulated when you retire

- Gap funding from #3 above multipled by the number of years in retirement. It's reasonable to assume 30 years during retirement.

Step 3 - Calculate how much you to save each month to reach your retirement goal.

Now that we know the lump sum that's needed at retirement. The next step is to calculate how much needs to be saved each month to reach that goal.

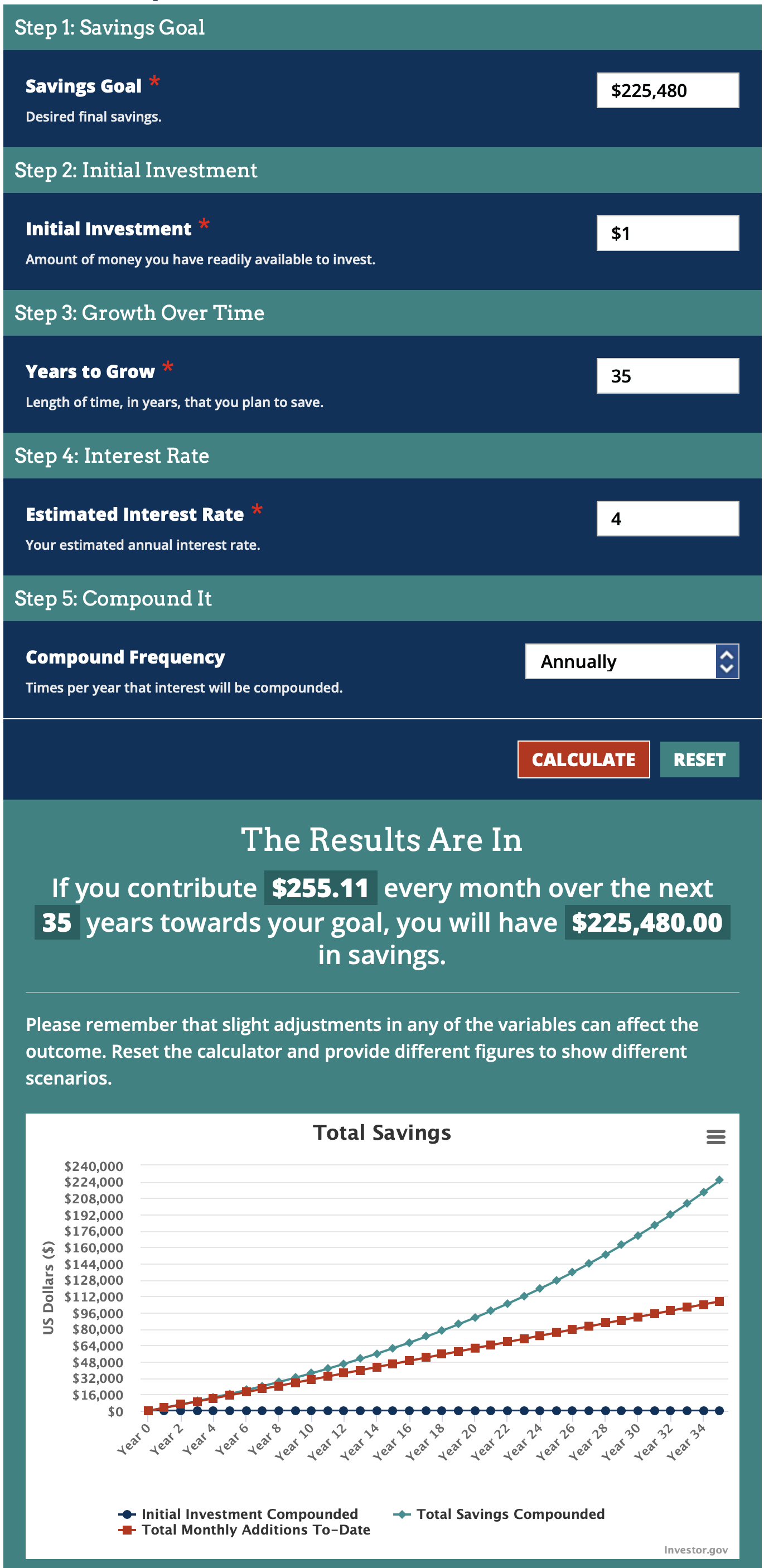

- Calculate your savings goal. Using the savings goal calculator, calculate how much you need to contribute each month to accumulate the desire lump sum at retirement. For illustrative purposes it's reasonable to assume a real rate of return of 4.0% (i.e., net of forecasted inflation). In this illustration you need to contribute $255.11 per month to reach a target lump sum of $225,480. This is in today's dollars, meaning it has already been adjusted for inflation.

- Convert the monthly contribution into a percentage of current compensation. Following the examples above, $255.11 per month for 12 months equals $3,061.32 per year. Divide the annual contribution amount by $40,000 in annual compensation in our example to arrive at 7.65%. This is the contribution expressed as a percentage of pay.

- Adjust the contribution for employer contributions. Assuming your employer contributes toward your retirement as a percentage of pay or as a matching contribution, your savings goal can be reduced by those contributions. Let's assume your employer matches dollar-for-dollar up to 4% of pay. Under this scenario, you only need to contribute 3.83% of your pay to your employer's retirement plan.

- Example: 7.65% total monthly contribution expressed as a percentage of pay ÷ 2 (employer match dollar-for-dollar) = 3.83%. This is how much of your pay you need to contribute. The other 3.83% is expected to be contributed by your employer.

Next Steps | Investment Strategies

Now that you have determined how much you need to have accumulated for retirement and how much you need to save each month, the next step is to set an investment strategy. Here's a link to How to build an investment portfolio.